-

foreclosure statistics 2022-2021

Homeowners across America are doing more research before borrowing

- We’re at a 15-year low in terms of foreclosures

- Most forecasts predict foreclosures to keep slowing in 2020

- 16 American states experienced upticks in foreclosures, including Mississippi

- Foreclosures rose 13% from December 2019 to January 2020

- Alaska’s foreclosure rate increased faster than any other state’s

- Florida has had it pretty good in foreclosing terms

Undated for 2022-2021 Foreclosure Facts

1. On an individual level, prospective homeowners conduct preliminary research prior to visiting a lender more than ever before

It’s true that the United States has the most robust economy in the world. Despite this wealth, Americans are still largely financially illiterate. This isn’t to say that people who don’t know much about personal finance are stupid; rather, most Americans are uninformed about personal finance, which isn’t inherently a bad thing. A decade ago, just over half of all prospective homeowners in the United States approached lenders after conducting preliminary research online – only 57% of them. Now, 92% of Americans who get mortgages looked into the topic online before getting mortgages or even talking to a lending professional in the first place.

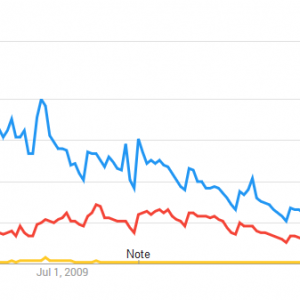

2. There are currently fewer foreclosures today than at any point in the past 15 years

A study conducted by a trusted market authority found that, in 2006, some 1,050,500 homes were foreclosed upon across the United States. In 2019, just 143,955 properties were subject to foreclosure proceedings. Although the researcher couldn’t dig up any data from before 2006, it’s safe to say that 2019 was the best year for foreclosures in the United States – at least from a borrower’s or homeowners’ perspective, that is.

3. Foreclosures will continue to drop in 2020

The majority of experts and real estate and consumer lending market authority figures and researchers all believe that 2020 will bring fewer foreclosures than what was expected in forecasts created last year. However, these experts weren’t able to predict that the novel coronavirus outbreak would end up rearing its ugly head, potentially throwing the good graces that American foreclosures are currently into the wayside. Although many lenders are being lenient with borrowers, giving them weeks or months past scheduled payment due dates. If it weren’t for this leniency, the number of foreclosures in the United States would likely be increasing thanks to the threat of COVID-19.

4. These markets are experiencing upswings in foreclosures unlike the rest of the United States

From 2018 to 2019, 34 states’ foreclosure markets decreased in terms of total foreclosures. The 16 other states weren’t so lucky. Mississippi is one of those 16 unfortunate states, reporting a whopping 56-percent increase in foreclosures throughout the state from 2018. This is likely tied to the disproportionate expansion of lending standards over the past few years in places like Mississippi, which haven’t been treated very well – that’s one of the premier reasons as to why lenders cut back on their standards in these places.

Note: New data for 2021-2022 shows that things are getting even worse!

5. A market recession may be closer than we think

Above, I referenced a widely-trusted 2019 end-of-year real estate market report for the United States at large that predicted the rate of foreclosures would continue to drop once the new decade began. However, at least for the first month of 2020, foreclosure filings actually increased from Dec. 2019 to Jan. 2020 by 13% up to a total of 60,085 filings. In terms of year-on-year change, the number of foreclosures in the United States rose 7% as compared to Jan. 2019. What this tells us is that we shouldn’t be so confident about the United States economy going forward, which is especially true now that we know the novel coronavirus pandemic would cripple the economy beginning in March.

6. Alaska could face a massive foreclosure rate increase

Alaska, although it’s the largest state in the country by terms of land area, is home to the second-to-least population of any state. The state doesn’t have much going on for it outside of natural resources. As you may know, since oil prices dropped substantially back in 2014, the state’s economy hasn’t been performing as well as it has over the past couple of decades. Despite this, the state’s real estate market is doing pretty well. Paradoxically, the rate of foreclosures in The Last Frontier grew faster than in any other state from 2017 to 2019, going from 0.20% of all homes to 0.37%. This could continue as a result of the coronavirus outbreak.

7. Florida has had a booming foreclosure presence in recent years

Florida is home to one of the most valuable, robust real estate markets in the United States. Due to the high property value that’s prevalent across the Sunshine State, Florida is also home to one of the highest rates of foreclosures. Together with the Golden State, California, Florida has pumped out more than 1.5 million foreclosures in the past decade alone. Florida will almost certainly continue to be home to a relatively high foreclosure rate in coming years, as people still value the property there quite highly.